tax avoidance vs tax evasion uk

The difference between tax avoidance and tax evasion essentially comes down to legality. HMRCs work on the tax gap.

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

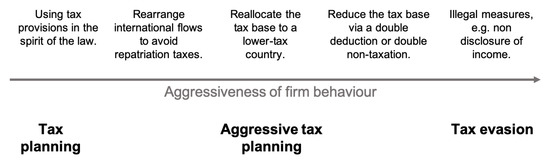

Tax avoidance and tax evasion Tax avoidance means exploiting legal loopholes to avoid tax.

. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the. It is estimated that in 201920. In the UK income tax evasion may result in a maximum penalty of seven years in jail.

Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B. Tax evasion can result in fines penalties andor prison time.

Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. Tax planning either reduces it or does not increase your tax. It always creates a lot of anger and questions about how to get away with.

Tax avoidance is when the rules of the tax system are deliberately bent to gain an advantage that was never intended to be made available. As the government states tax avoidance. Tax Evasion refers to the adoption of illegal methods for reducing the liability of payment of taxes such as manipulation of business.

The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying. Tax evasion means illegally hiding activities from HMRC to avoid tax.

Here is quick and detailed guide about Tax Avoidance vs Tax Evasion. On 16 Feb 2022. Tax avoidance and tax evasion Summary 1 Introduction.

In its most simplistic. Tax evasion is the use of illegal methods of concealing income or information from the IRS or other tax authority. What is tax avoidance and what is tax evasion.

Difference Between Tax Evasion and Tax Avoidance. If you are facing charges of tax evasion or tax fraud it is imperative to have experienced attorneys on your side every step of the way. 2 The tax gap 3 The Coalition Governments approach.

The process of avoiding and evading taxes is known as Tax Avoidance and Tax Evasion. Summary conviction for evaded income tax carries a six-month prison sentence and a fine up to 5000. However tax evasion is much different.

Avoiding tax is legal but it is easy for the former to become the latter. It even makes big news for celebrities and large multinationals. According to most recent official estimates tax avoidance in the UK costs the Exchequer about 18bn a year while tax evasion is believed to cost an eye-watering 53bn.

The attorneys at Weisberg Kainen. How serious is tax evasion UK. Tax avoidance has always created interesting news.

But what is the difference between the two. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. More serious cases of income tax evasion can result.

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Tax Avoidance Vs Tax Evasion What S The Difference

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

James Melville On Twitter Claw The 120 Billion Back From Tax Avoidance Evasion Amp The Uk Deficit Would Be Wiped Out Taxhaven Panamapapers Https T Co Hvcr6ou150 Twitter

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

The Economics Of Tax Avoidance And Evasion The International Library Of Critical Writings In Economics Series 334 Dharmapala Dhammika 9781785367441 Amazon Com Books

22 Taxing Quotes On The Good Bad And Evil Of Federal Income Tax

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Your Thoughts Tax Avoidance Offshore Loopholes

Concept Of Tax Evasion Tax Avoidance Definition And Differences