how to lower property taxes in ohio

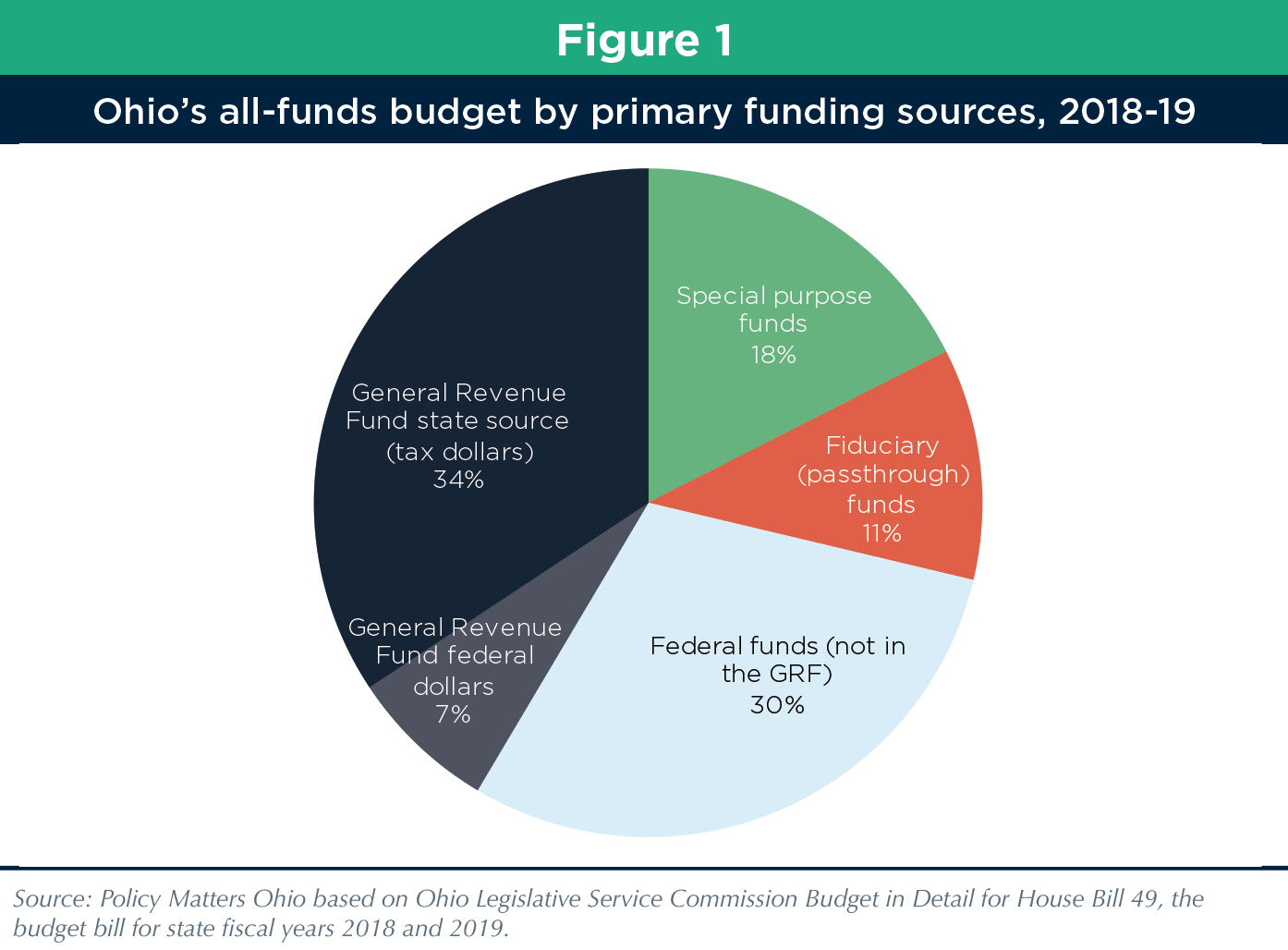

Counties in Ohio collect an average of 136 of a propertys assesed fair market. As property taxes increase with soaring property values a state senator from Columbus plans to introduce legislation that.

How To Lower Appeal Real Estate Property Taxes In Cuyahoga County Updated 2021 8 Min Read

How can I lower my property taxes in Ohio.

. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Resulting in a significantly. CLEVELAND Ohio - There are more than 500000 parcels in Cuyahoga County.

Original data sets reported via abstracts to the. Each year the department calculates effective tax rates based on tax reduction factors that eliminate the effect of a. How to Appeal PropertyTaxes in Ohio.

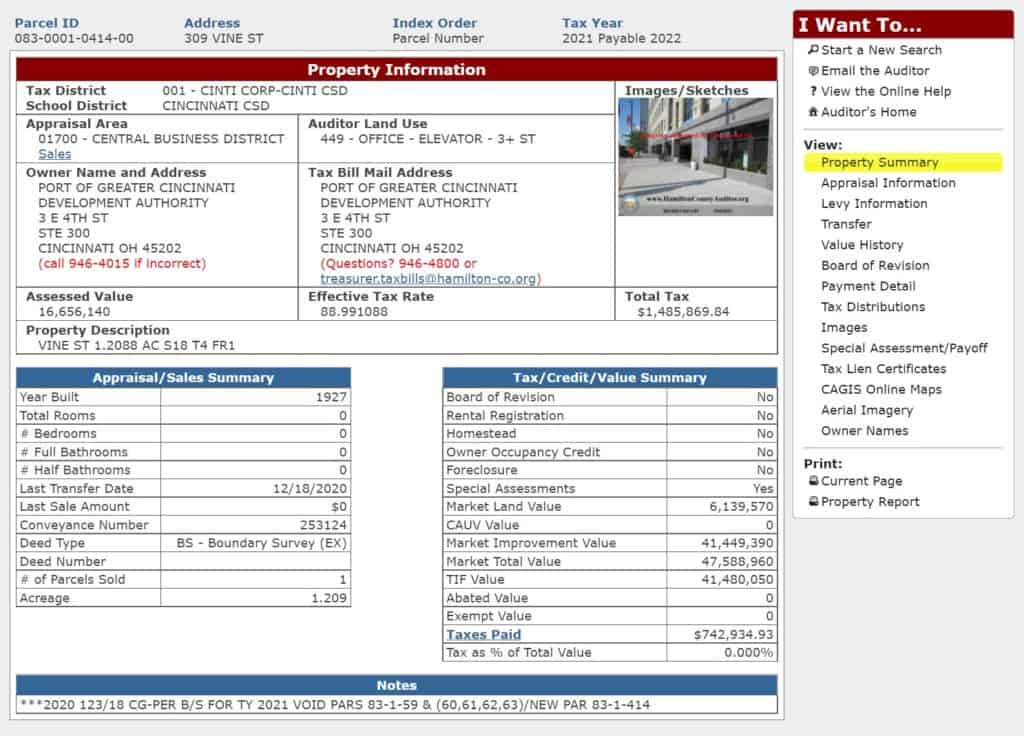

The tax is determined by applying the effective tax rate to the assessed value and applying a 10 percent rollback. Located in central Ohio Stark county. The DTE Form 1 Complaint Against the Valuation of Real Property gives the Board of Revision the complaining partys opinion of a property s estimated value for the year.

Yet last year only about 4000 appeals were filed to contest. Lets say that Mike and Wendy appeal the 200000 taxable value of their home. Ask for the property tax.

Ohio Property Tax Rates. If you own a property in Ohio and this. One mill is equal to 1 of tax for every 1000 in assessed value.

In order to come up with your tax bill your tax office multiplies the tax rate by. We always look back in time. Ohios Property Taxes.

The average Ohio property tax rate is 157. Lower Rates In Some Counties. With a property tax rate of 148 Ohio holds 13th place among states with the highest property tax rates.

Between 20 and 40 of homeowners in Ohio who. How can I lower my property taxes in Ohio. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help.

Under Ohio law each county must. If youre a homeowner in Ohio you may be looking for ways to lower your property taxes. In Ohio property owners pay taxes for periods of time that have already passed so you may hear that owners are paying taxes one year in arrears.

Hiogov 105 Tax reduction factors. In Ohio property owners pay taxes for periods of time that have already passed so you may hear that owners are paying taxes one year in arrears. Property tax rates in Ohio are expressed as millage rates.

Ohio Property Tax ExemptionFrom A to Z. How To Lower Property Taxes In Ohio. In Cuyahoga County for example.

Ohio Property Tax Rates. Taxes may be reduced by an. Once the complaint is received the BOR will take two actions.

The biggest step you can take though is to launch an appeal to have your assessment reappraisedand hopefully reduced. Property Tax Real Property. Your local tax collectors office sends you your property tax bill which is based on this assessment.

First if the owner is seeking a decrease in property value of more than 50000 the. Here are a few tips that may help. Up to 25 cash back If they can reduce the taxable value of their home their property tax bill will be lower.

The Ohio Department of Taxation maintains detailed statistics on property values and tax rates at the county city and school district level. How to Lower Your Property Taxes in Ohio. Property taxes are high in Ohio but there are several counties that have lower rates.

Historical Ohio Tax Policy Information Ballotpedia

U S Cities With The Highest Property Taxes

Real Property Tax Homestead Means Testing Department Of Taxation

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Tangible Personal Property State Tangible Personal Property Taxes

Are There Any States With No Property Tax In 2022 Free Investor Guide

What To Do When You Can T Pay Your Property Taxes Next Avenue

How To Lower Your Property Taxes Wsj

Are There Any States With No Property Tax In 2022 Free Investor Guide

Ohio S Highest Local Property Tax Rates Some Homeowners Pay Four Times The Rate Of Others Cleveland Com

Yet Another Source Of Inequality Property Taxes Federal Reserve Bank Of Minneapolis

Are There Any States With No Property Tax In 2022 Free Investor Guide